How to Work from Home

March 25, 2020

Tax Deadline Delayed

April 8, 2020

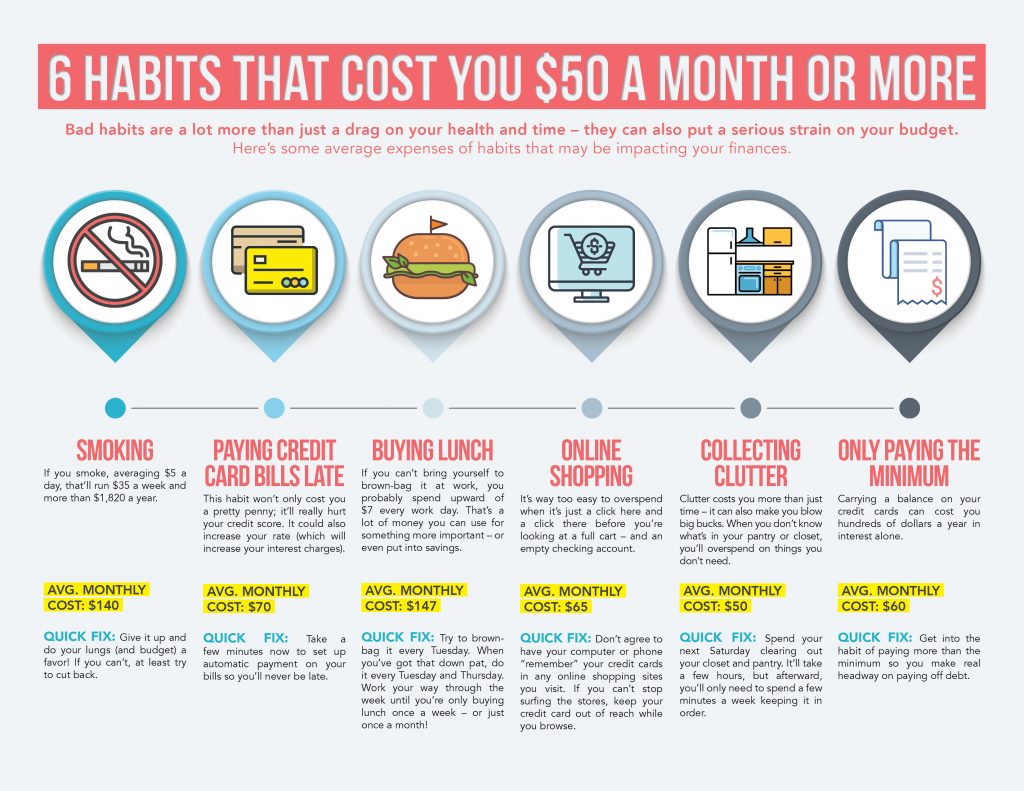

Bad habits are a lot more than just a drag on your health and time – they can also put a serious strain on your budget. Here’s some average expenses of habits that may be impacting your finances.

1: Smoking

If you smoke, averaging $5 a day, that’ll run $35 a week and more than $1,820 a year.

Avg. Monthly Cost: $140

Quick fix: Give it up and do your lungs (and budget) a favor! If you can’t, at least try to cut back.

2: Paying credit card bills late

This habit won’t only cost you a pretty penny, but it will also really hurt your credit score. It could also increase your rate (which will increase your interest charges).

Avg. Monthly Cost: $70

Quick fix: Take a few minutes now to set up automatic payment on your bills so you’ll never be late.

3: Buying lunch

If you can’t bring yourself to brown-bag it at work, you probably spend upward of $7 every work day. That’s a lot of money you can use for something more important – or even put into savings.

Avg. Monthly Cost: $147

Quick fix: Try to brown-bag it every Tuesday. When you’ve got that down pat, do it every Tuesday and Thursday. Work your way through the week until you’re only buying lunch once a week – or just once a month!

4: Online shopping

It’s way too easy to overspend when it’s just a click here and a click there before you’re looking at a full cart – and an empty checking account.

Avg. Monthly Cost: $65

Quick fix: Don’t agree to have your computer or phone “remember” your credit cards in any online shopping sites you visit. If you can’t stop surfing the stores, keep your credit card out of reach while you browse.

5: Collecting clutter

Clutter costs you more than just time – it can also make you blow big bucks. When you don’t know what’s in your pantry or closet, you’ll overspend on things you don’t need.

Avg. Monthly Cost: $50

Quick fix: Spend your next Saturday clearing out your closet and pantry. It’ll take a few hours, but afterward, you’ll only need to spend a few minutes a week keeping it in order.

6: Only paying the minimum

Carrying a balance on your credit cards can cost you hundreds of dollars a year in interest alone.

Avg. Monthly Cost: $60

Quick fix: Get into the habit of paying more than the minimum so you make real headway on paying off debt.