TVACCU Kids Clubhouse Account

For ages 14 & Under

All Kids Clubhouse Savings accounts are valid up to age 14 and require the standard $25 deposit to open the account.

You're Never Too Young To Be Good With Money

The perks of a TVACCU Kids Clubhouse Account

- Cash for good grades

Not only does our Kids Clubhouse account teach children the importance of saving money, it also rewards them for working hard in school. Your child can earn the following for good grades:

- $20.00 for all A's on their report card

- $10.00 for A's & B's

- Cash for making deposits

Our Kids Clubhouse Punch Card gives your child a chance to earn rewards and cash for deposits. Your child will receive their Punch Card upon account opening. Every deposit ($25 minimum) = one punch on their card. (Child must be present) At 10 punches, we will deposit $20 into their account.

- Get a trip to the TREASURE CHEST for a fun reward each time you visit one of our branches & make a deposit.

- Start good savings habits

How many times have you wished that you had learned the basics of smart money management sooner? A Kids Clubhouse Account is the perfect way to teach your kids the importance of savings and how to set savings goals, whether they’re saving for a bike or their college tuition. As they watch the balance on their account grow, they will be motivated to become smarter consumers and better savers as they grow up.

Here are some great tips to help your young one develop smart money skills!

- Manage your child's account

As a joint owner on your child’s Kids Clubhouse Account, you can conveniently link their account to your online and mobile banking for easy account viewing and transfers.

Teaching Kids About Money

Whether you’re a stay at home parent or a working parent, regardless of what your official title may be, when it comes to our kids, we’re all teachers. Even on days when we may not realize it, we’re teaching our kids something. They’re always watching and learning from us. That same principle applies to the things that we teach our kids about money. Their view of money and its role in our lives begins at home with us.

It’s up to us to ensure that we teach our kids how to handle money responsibly! To help make that happen, here are a few good pointers and some fun activities to get them started in the right direction!

1. Start them at a young age.

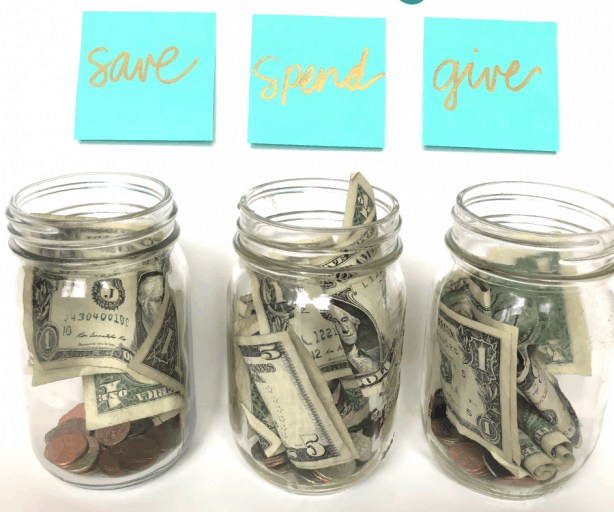

It’s never too early to start teaching your children about money and finances! Think about it this way: the earlier you start, the more exposure they have! And the more exposure your child has about money, the more prepared they will be to grow up and handle money as young adults. Start by giving them an allowance for helping out around the house. Then, give them three quarters for their work. You can easily separate the money into three categories: SAVE, GIVE and SPEND.

2. Teach them to SAVE money.

Kids need to learn that saving money is the KEY to financial success. Just

like you make your children brush their teeth to develop healthy habits, you

should teach them to save part of their money. So whether your child is a

teenager and working a part-time job or a 4-year old earning quarters for

picking up their toys, it’s important to teach them the importance of saving

some of their money!

Anytime our children earn money, get them to put some of their money in

their “save” jar or their TVACCU Kids Club piggy bank.

Saving 20% of their money is a good place to start.

Many people are wired to be spenders or savers. Spenders walk into a store

needing one thing and leave with $200 worth of things they don’t necessarily

need. With a little practice, spenders can learn to get that same thrill

from saving. We’ll set our kids up for success by teaching them this lesson

early on.

3. Teach them to GIVE.

The act of giving has the wonderful ability to bring joy to adults and kids alike. Kids need to learn that giving is good. They need to be taught to give of their time, money, and heart. The best way to teach them to give is by allowing them to see their parents give and to have an opportunity to give themselves. Giving your time and resources not only helps others, but it brings people joy. Have your children set aside a portion of their income or allowance (10% is the perfect amount!) to give to someone in need, a church, or a charity. Not only will the person receiving be thankful, but you’ll be giving your child the gift of joy. Be sure to take in their smile when they offer over their giving!

4. Teach them to SPEND wisely.

It’s important to teach children how to spend wisely. Teach them to put thought into what they want to buy. It means that they think about it for more than 5 minutes before they make the purchase. Teach your children to be patient in their spending, do their research, and decide if the purchase is one that they really want. It’s important that they grasp the concept of wants vs needs. And if they don’t have the money for the item they’re wanting just yet, teach them to save for it!

5. Talk about your budget in front of them.

Hearing adults having an effective conversation about money is a valuable lesson for children. The more they hear about it at home, the more they will be able to apply it to their lives when they are adults. Think about it this way: would you rather send your son or daughter off into the real world with a strong foundation of how finances work, or would you rather let them figure it out on their own? And that foundation starts at home. One of the best ways to give your children that foundation is to let them see budgeting in action. Let them see what it looks like to pay a bill. Let them see you track your spending whether you write it all out on paper or use an app. You are their teacher!

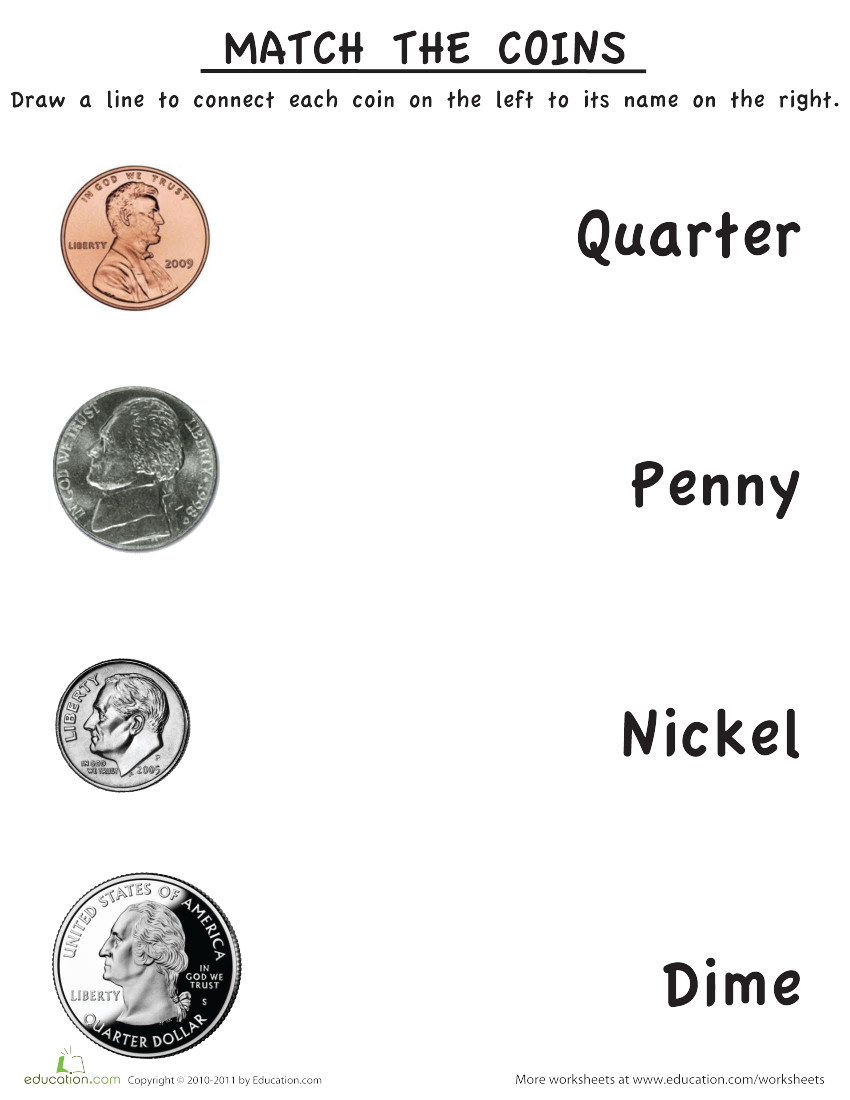

Learn about US currency from the U.S. Currency Education Program.

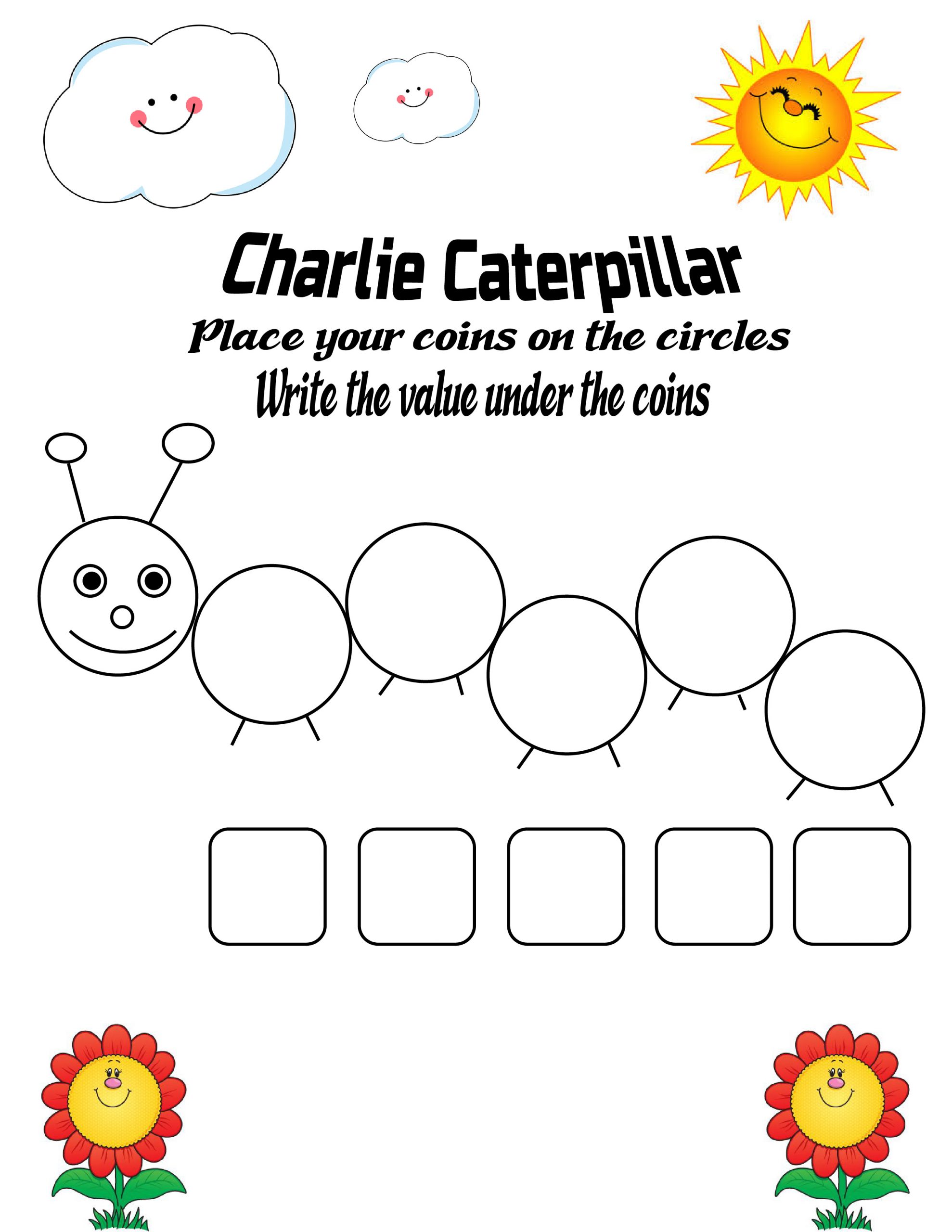

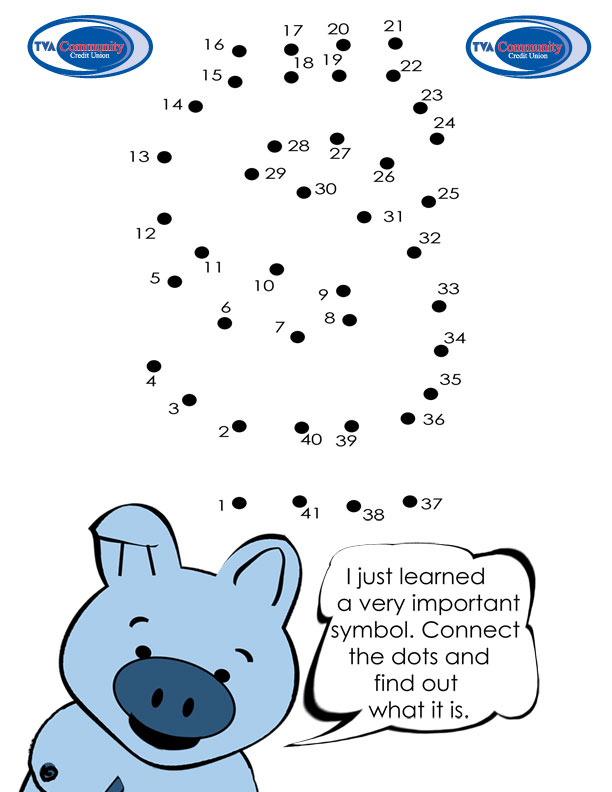

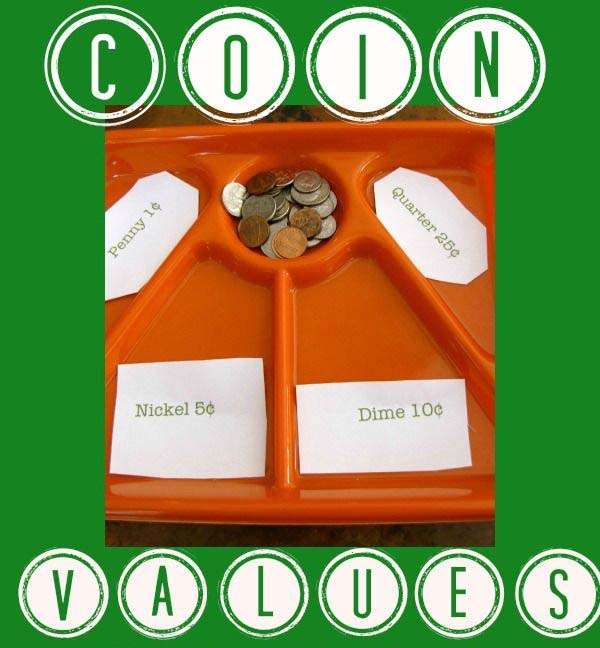

Fun Activities

Click or tap on images for a printable version